Towards the back end of last year, Bud’s development teams were working on a series of major updates to the platform. These have now started to roll out and since Christmas, the platform has undergone two huge releases, massively increasing the breadth and depth of our aggregation, enrichment and marketplace APIs.

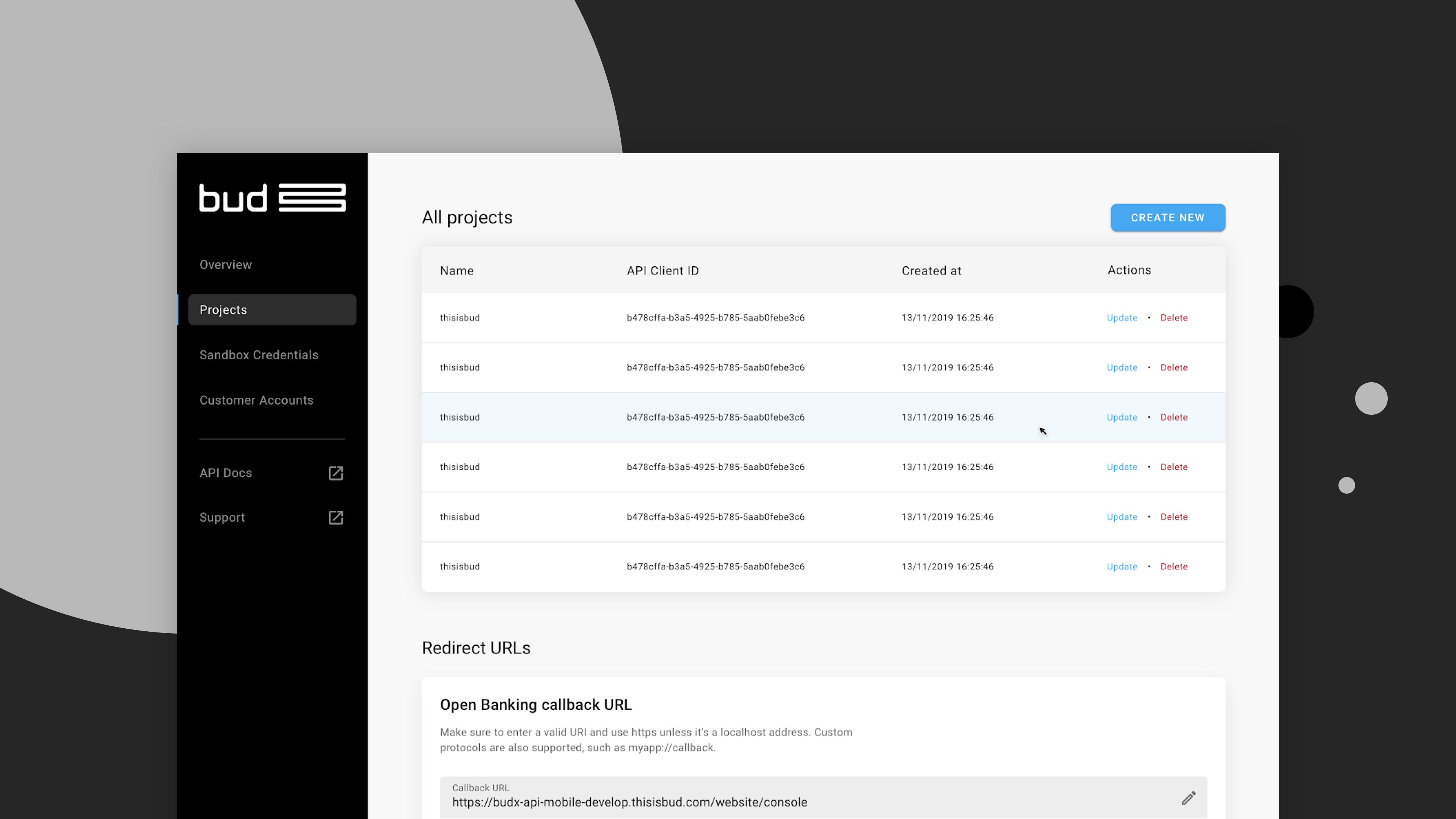

On the aggregation front, not only have we increased the total number of supported providers by 70%, we have also made it quicker and easier for our clients to integrate our Open Banking aggregation APIs through the use of Bud’s Authentication Gateway - a brand new piece of user interface (UI) allowing Customers to connect their account in just a few clicks. On top of that, clients are now able to aggregate their Customers’ PensionBee, Wealthify and Wealthsimple accounts via Bud’s brand new Investments & Pensions Aggregation API.

For customers that aren’t regulated by the FCA to provide AISP we’ve introduced the capacity to act as an agent of Bud and alongside that, we’ve launched a new user-flow that makes it crystal clear to end users what’s happening to their data and how it will be used. (for more on that check out our white paper on data usage)

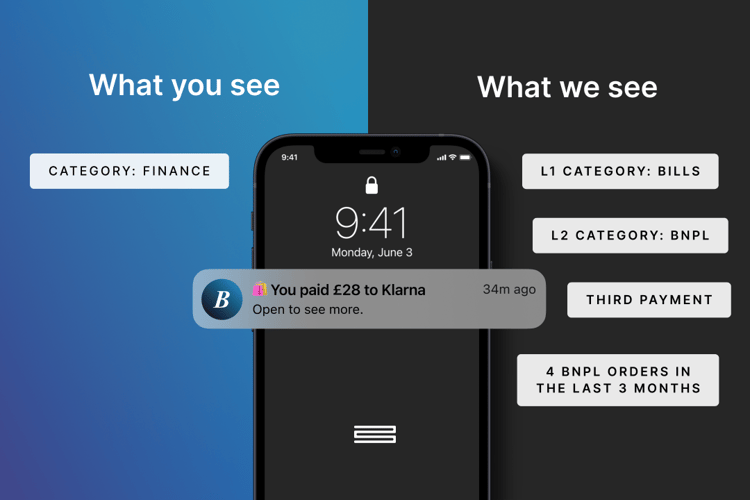

Bud’s enrichment services suite has tripled in size, with the inclusion of a whole new host of endpoints for aggregated data.

- Clients now have an endpoint dedicated to finding the different transactions associated with a Customers income.

- Bud’s regular transactions engine has been expanded to include two new endpoints: one that allows clients to see the transactions that have been found to occur over a monthly and quarterly period, and another that predicts what is due to come into or out of a Customer's account(s) over the next three months.

- In addition, Bud’s merchant identification service is coming along leaps and bounds, with clients now able to see a Customer’s top merchant spends over the period requested.

Perhaps the most exciting set of additions however come under the banner of Bud’s marketplace (or distribution) APIs. These use connections to different third party products and services to make it easier to solve users problems in our clients’ apps. These new journeys give clients the capacity to start tackling the loyalty penalty with a simple set of APIs that allow users to obtain quotes and fulfil with a number of different home insurance providers, and switch their Energy and Broadband providers, all from the comfort of clients’ applications.

All in all, the new additions combine to give a strong sense of the direction we’re taking the platform. We want to help foster innovation by making it easier to bring financially intelligent products to market. Right now it’s way too hard to build interesting things with transaction data. Our platform, and this update are designed to address that.

To find out more - check out our developers page and sign up to discuss how bud’s platform can help you to help your customers.