As inflation rises and households feel the squeeze, our clients are focussing on how they can better support their customers.

Over the past few years, there has been an increasing recognition from organisations that they are responsible for putting the needs of their customers first.

Aviva certainly believes that.

In an industry-first for the pensions sector, Aviva have selected Bud to provide the tech behind their new money management tool. Once launched, Aviva’s clients can offer this new capability to their employees as a complementary service alongside their workplace pension.

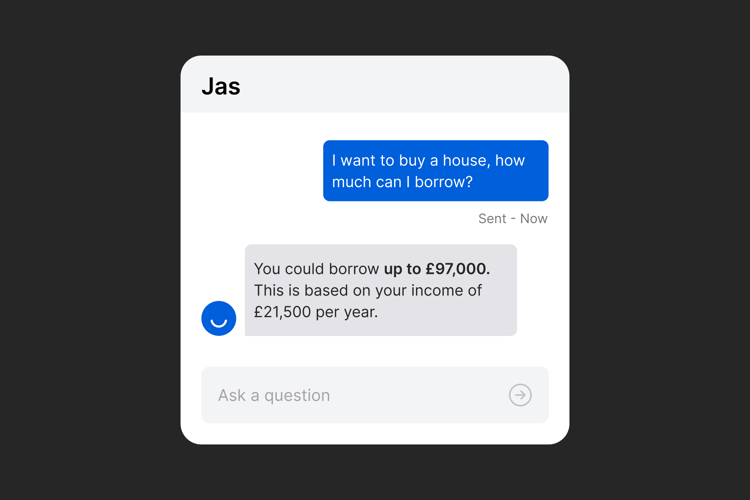

The Aviva money management tool will help customers to:

- Gain greater awareness of their every day spending habits,

- Identify high cash balances in current accounts that can be better used elsewhere (such as a pension contribution),

- Identify increases in bills and opportunities to switch,

- Identify potential double-charges and high value transactions.

Aside from being an exciting customer-facing proposition with a house-hold name, this is a landmark project in several ways.

We estimate we’ll be helping more people than any other Open Banking platform in the UK to benefit from their financial data. That’s a huge step towards our goal at Bud of making sure that everyone, everywhere, can benefit from their financial data.

Secondly, it's a significant sign of confidence in the Open Banking ecosystem to see a non-bank institution with the scale of Aviva moving in this direction.

We’ve said since day one we think Open Banking’s real value lies in the ability to understand and harness financial data - delivering intelligent insights that help institutions to serve customers better.

Projects like this only serve to reinforce that belief.

For more information on the tech behind Aviva’s Open Banking dashboard check out our Connect and Intelligence products, or drop us a note through the form below and we’ll get in touch.