It’s been clear for some time now that Open Banking's impact will only really start to be felt when it delivers value to customers and helps institutions bring product to market. Offering aggregation alone doesn't achieve this.

There are user benefits to being able to see account information in a single place. For a specific type of customer, those benefits are enough to warrant going through the process but, for a majority, this isn’t currently the case.

This isn’t to say that Open Banking isn’t having a transformational impact on the way we understand people’s finances. It is, it’s just not landing where the industry expected it to. The biggest change that Open Banking has brought about is in the availability of data that can be used to train AI models.

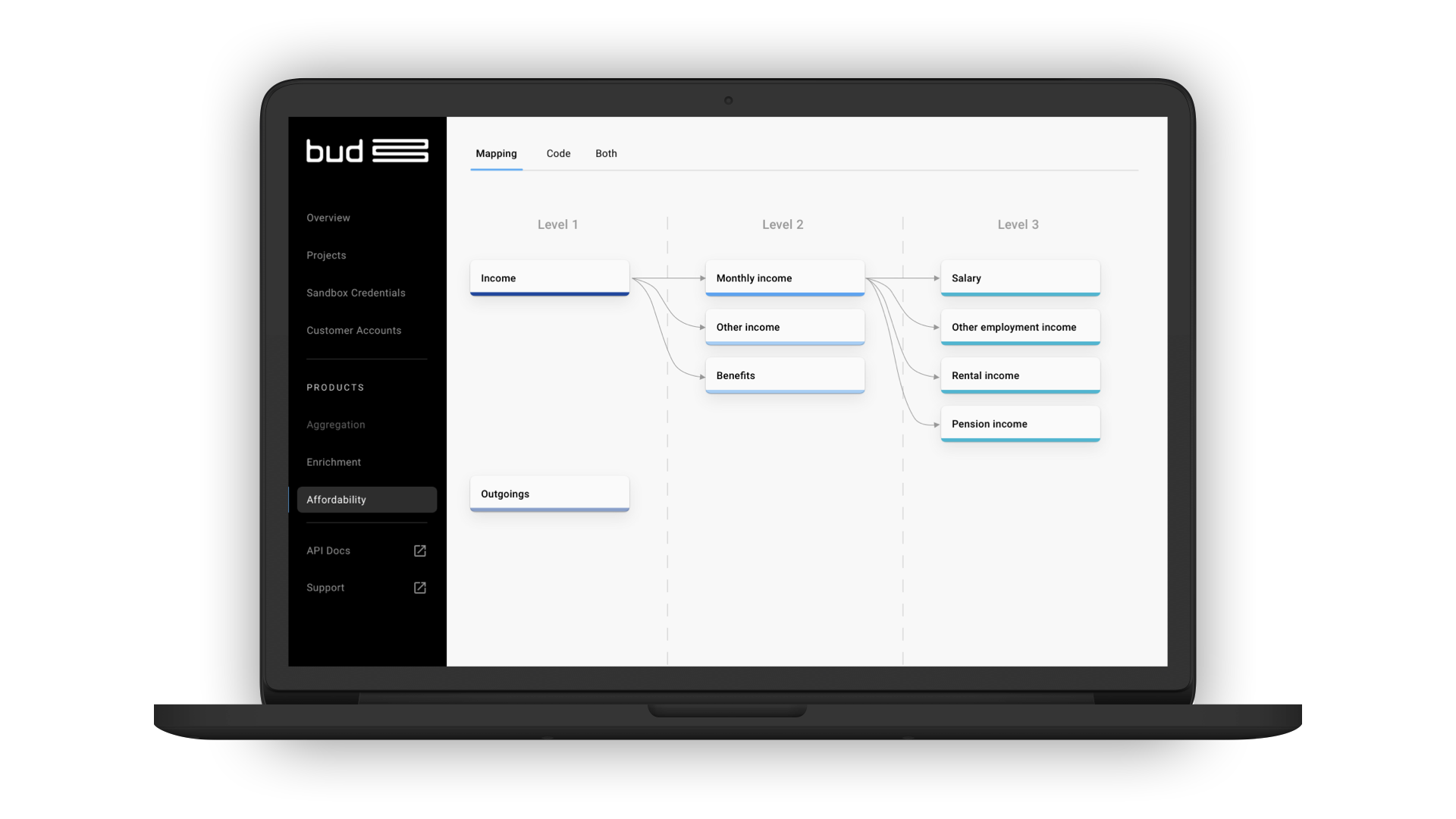

Two years ago our categoriser (designed at the time to help power PFM tools), sorted transactions into one of 12 categories. It was more than 90% accurate which was great, but now the number of categories is more than 200, and with that granularity comes the key to unlocking the real opportunity for the next generation of financial tools. When you can distribute product by helping a customer find better pet insurance, or protect your loan book by helping at-risk customers cull unused subscription services - that’s when the promise of Open Banking starts to get fulfilled - and that’s where we are now.

Intelligence as a service

That level of intelligence should be available whether or not you’re ingesting data via Open Banking. So earlier this week we shipped an update that decouples our aggregation gateway from our core intelligence platform. This is a pretty significant breakthrough, something we have been excited about for most of this year.

You can still use our aggregation (and you should because it’s great) and we’ll continue to invest in expanding our coverage of banks - but you can now access our industry leading AI regardless of whether you ingest data via Open Banking. We can accept 1st party (your own) data in almost any format or language as well as data that you’ve accessed via any of the other leading Open Banking aggregators.

The changes allow us to open our financial intelligence services to anyone who holds transaction data or aggregates Open Banking data regardless of how they do it or who they do it with. This will give you access to our categoriser, merchant ID, regular payments and financial insight services. Which, combined, will give you an unrivalled level of insight into, and capacity to deliver on the goals of your customers.

Security as a service

Over the last 18 months, we’ve been working alongside some of the largest, most complex and (rightly) the most risk averse institutions in the world when it comes to the protection of people’s data.

The result of this work is that, alongside access to our intelligence platform, you get access to the gold standard for data security. End users’ personal information is encrypted with a unique key for every user and that key is available only to the client and the end user. No Bud staff ever have access to that information. In taking this approach, we’ve made it deliberately challenging for ourselves to build the kind of machine learning models that set us apart, but in doing so we’ve reduced both the risk and potential impact of a data breach to an absolute minimum.

The problems around data sharing and security have been one of the biggest blockers for institutions looking to deliver on the potential of AI to create intelligent financial services. With this latest iteration of our service, and given the evidence coming back from the people we’re working with, we believe this is solved.

-1.png?width=3240&name=image%20(3)-1.png)

An intelligent future

The latest version of our Intelligence product provides institutions with all of the basic building blocks necessary to create genuinely personalised apps and services and our next focus will be on making this process faster. We’ve already started to include insights services built on those building blocks and we’ll be rolling out a series of exciting new features over the coming weeks and months designed to further reduce the length of time that it takes to get new services to market.

Ultimately we’re here so that the right people get the right information at the right time to enable better financial decisions to be made for everyone, whether that's by individuals or institutions. And we know that, to achieve this, we have to do three things.

- We have to turn transaction streams into clear, contextual data ready to power new apps and services.

- We have to reduce the length of time it takes to get good results from a proof of concept so that promising ideas can make it to large scale roll-outs.

- We have to provide the “next step” in financial journeys so that insights can be turned into actions.

With the latest version of Bud’s platform, we’re now in a place where we can say that we can solve for all three of these. It’s going to be an exciting year - so if you’re an institution with the same kind of ambitions, why not get in touch?