Everything we do at Bud is about helping people to get where they want to in life and we’ve spent the last 2 years working almost exclusively with big financial institutions because that is where people are most at home when they’re managing their money.

That’s not always going to be the case.

We’ve said consistently that financial services should be delivered at the point of need. That means creating an infrastructure that allows financial products to be accessed in a way that integrates seamlessly with the way people live their lives.

Today we’re taking another big step towards that goal with the launch of our SME / fintech platform. It takes almost all of the work that we’ve put into our enterprise product and exposes the APIs through a self-service portal that is open to all comers regardless of size and sector.

The live environment includes access to:

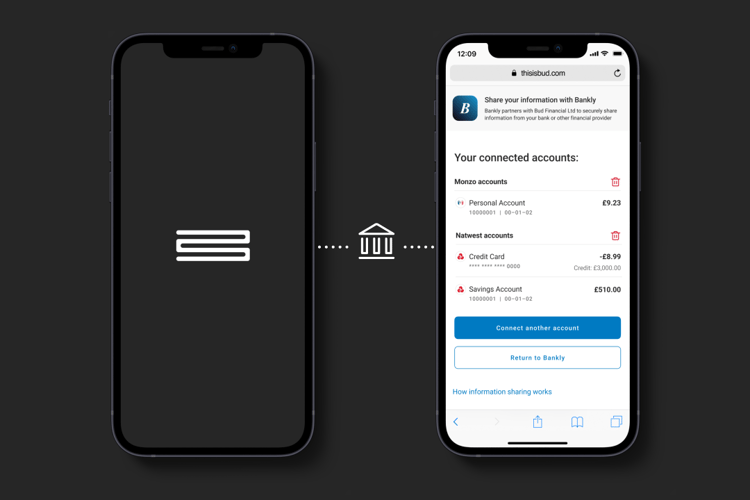

- Open Banking via Bud’s AISP licence

- A suite of enrichment APIs designed to help treat data more intelligently. These include microservices for transaction categorisation, transaction tagging, merchant identification; as well as the ability to isolate key transactions like regular payments, rent payments, utility bills and salaries.

- Access to all the elements of the connected marketplace necessary for completing rent recognition and utility switching journeys with more coming soon.

For companies that want to test new use cases and assess the technical feasibility of their ideas, there’s free access to a sandbox environment that will combine Open Banking sandboxes from some of the CMA 9 banks with dummy data and access to Bud’s API platform. This allows for complete end-to-end testing of the platform.

This is a product designed to foster innovation. That means delivering in a commercially viable way for young companies — we want to drive down the cost of innovation both in terms of development time (through offering intelligence as a service), and in terms of the key commercial aspects. With this in mind, we’re confident that the commercial structure will make this the most cost-effective way of getting access to Open Banking on the market today.

Of course, none of this would mean anything if we were to compromise on the enormous amount of work that went into making our platform attractive to large institutions. The SME platform takes the exact same tried-and-tested approach to security and resilience that we developed to service our enterprise customers. Users’ data is uniquely encrypted for each user both in transit and at rest and is only decrypted at the point of use.

The UK has an amazingly creative fintech sector full of smart and committed people, and by giving them the tools to create experiences that are currently not viable we’re aiming to fuel that creativity. User focussed innovation — doing smart, new stuff that helps people — is at the core of everything we do and we’re really excited to see what opportunities we can open up with the new portal.

Check out the website or get in touch directly using help@thisisbud.com if you’d like to know more.