Over the last 2 years we’ve been working with HSBC first to help frame, then to help test the potential that Open Banking can deliver for their customers. Today we’re announcing that we’ve moved on to a new and exciting phase of that relationship as we start working towards delivering on that potential.

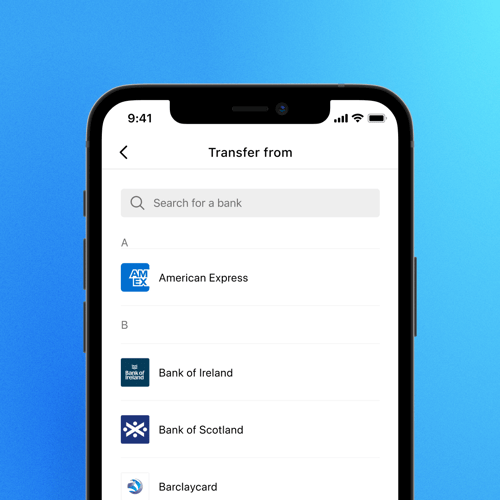

We’ve now agreed a global deal that will give HSBC access to our technology in markets across the world. Our first deployments will be in the UK with first direct, and later in the year with HSBC’s UK bank. They’ll be focussed on aggregation and enrichment at first but the deal is designed with marketplace in mind and specifically highlights both our rent recognition and utility switching services.

For more information, you can download the press release here.

The deal is the culmination of months of hard work and we come out of that process immeasurably stronger as a business than we were going into it. The process has helped us to re-imagine and then stress test an approach to handling consumer data that we believe should be considered as a standard for the industry (check out our data white paper for more on that). It’s helped us to test and deliver on enrichment technology that aligns with institutional needs and it’s helped us to work through and simplify the complex regulatory and compliance procedures that run alongside our marketplace.

As we move into 2020 we’re incredibly excited to do what, as far as I know, no other fintech has done and start to fulfil the potential of open banking on a global scale with a major bank.

- Ed Maslaveckas