As we start to acclimatise to life under lockdown, institutions are beginning to articulate the role they can play in the recovery. In particular, savings and investment providers stand to gain if they can make the most of any economic bounce-back to help customers become more financially resilient.

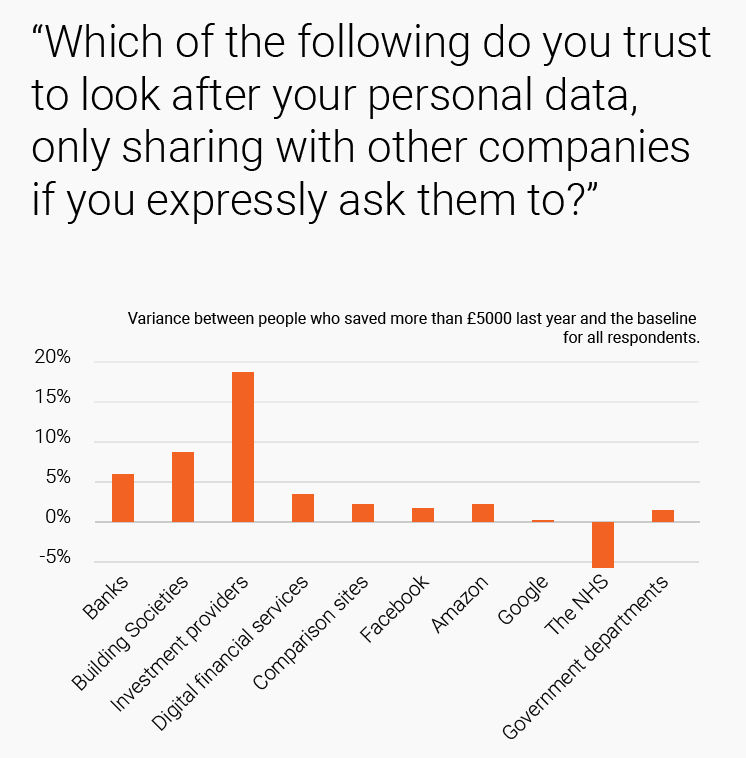

These providers are in an enviable position to move fast with “savers*” almost 20% more likely than the average respondent to our latest Beyond Open Banking study to say that they trust their provider to be a responsible custodian of their data. With stocks and shares tanking just as ISA providers were gearing up their end of year campaigns, this trust should be seen as an opportunity to pursue a data-led approach to winning back those casual investors, whose fingers have been burned over the last months.

Financial intelligence as a driver of behavioural change

Open Banking presents an opportunity, not just to present people with a complete picture of their finances but to use the data to build insights that enable more personalised services. Aggregation is, of course, an important feature of Open Banking - and it does drive further engagement - but it should not be seen as the end goal. To do so would be to miss the real opportunity.

We know that insights delivered in-context are far more likely to drive behavioural change and access to clean, standardised, and enriched data is fundamental to delivering this. For those providers that can genuinely intelligent nudges, the potential is obvious - It is the difference between an email reminder that “now might be a good time to save / invest” and a notification landing on the day before payday suggesting that a user will have X left over when her salary lands and that the spare cash could be worth a multiple of that over a period of time.

Enter PISP

A step beyond providing insights, Open Banking’s infrastructure opens up opportunities to provide closed-loop user journeys by facilitating payments where the initiating factor is a behavioural nudge. The PISP infrastructure is nascent, but for use-cases like this (e.g. account top up) it is robust and commercially attractive, providing both a more seamless user experience and a much lower cost per transaction.

Serving customers intelligently

There’s no doubt that the way institutions act over the coming weeks and months will shape the way they are perceived by customers - at least over the medium term. We’re seeing that in the dramatic cut-backs in direct marketing and the way that institutions are shifting the role of digital channels towards being service centres rather than revenue centres . The opportunity now lies in the intelligence, it lies in finding ways to align commercial interests with customer success. That’s the fundamental shift that Open Banking is instigating and, where the current crisis makes the need more acute, it will only speed up the pace of change.

For more information, schedule a call with a member of the Bud team!