Prompting people to take action on their finances is hard.

Institutions’ messages need to be timely, relevant and actionable and to deliver that, you need data. But, getting reliable and timely data that outlines those key events that we know prompt customers to take action is close to impossible.

Machine learning:

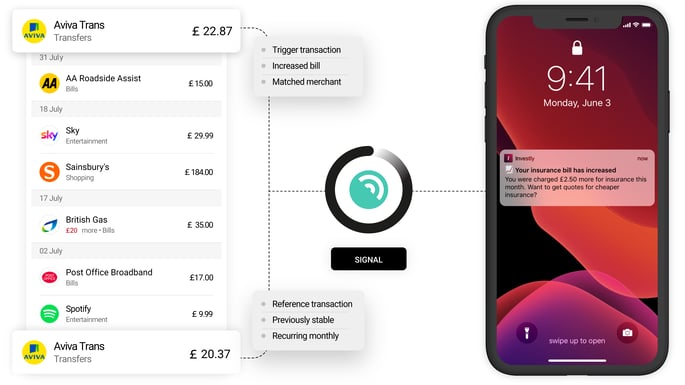

Signal is our way of solving this problem. It takes data, either from our Open Banking Aggregation tool or our clients' own data sources, and uses the same machine learning algorithms and neural networks that underpin our Intelligence core to help clients define triggers and prompt customers to take action.

We’ve created this by layering a new trends engine over the enriched data produced in the Intelligence core. Signal can monitor category, custom (compound) category and merchant trends over any given period of time, spot changes and notify our clients when an event is occurring that might give them the opportunity to help a customer.

Finances in context

.png?width=300&name=image%20(14).png) Signal can be used for something as simple as spotting an increased bill, but can also support far more complex implementations. Examples range from alerting users to increased spending in a given set of categories over a period of months, to spotting when an account’s balance is not sufficient to cover upcoming bills and beyond. The key is in its flexible design and the simplicity with which it can be set to work.

Signal can be used for something as simple as spotting an increased bill, but can also support far more complex implementations. Examples range from alerting users to increased spending in a given set of categories over a period of months, to spotting when an account’s balance is not sufficient to cover upcoming bills and beyond. The key is in its flexible design and the simplicity with which it can be set to work.

Signal ships today with an initial set of triggers covering the key use-cases that will define what we think of as phase 2 of Open Banking - leveraging open data to create experiences that are capable of prompting people to take action. These triggers include changes in income, insufficient balance to cover recurring transactions, changes in spending categories and more. For the full list, download the fact sheet below, or get in touch with our sales team to discuss your challenges.

Download the fact-sheet